V-twin dealers focus heavily on tire sales

Motorcycle tires selling in the $100-$200 range dominate all measures of tire sales activity; a V-twin dealership stocks double the dollar value of tires as a metric store; and metric dealers the South and West regions of the U.S. sell a greater percentage of tires than all other regions of the country.

These are just some of the facts that emerged from an in-depth ADP Lightspeed tire study of 1,323 powersports dealers over the past 16 months — from January 2011 through April 2012. Total parts sales for these dealers during this time period were $2.1 billion, with tires making up $112 million — or 5.3 percent — of that total.

The study, provided exclusively to Powersports Business, focused on three different areas: unit sales, dollar sales and margin based on the selling price of the tires; tires sales measured against the total parts departments sales; and tires stocked in dealership inventories.

Tire sales by selling price

Sales of tires were separated by selling price, beginning at $20-$100. The lower limit of $20 was used to eliminate tubes, valve stems and other tire-related items that were grouped in the tire category. Subsequent ranges were units (tires) selling within the following price ranges:

• $100-$200

• $200-$300

• $300-$400

While there were tires sold at prices upwards of $1,000, the numbers were so few that they were not included in this analysis, where $400 was set as the upper limit.

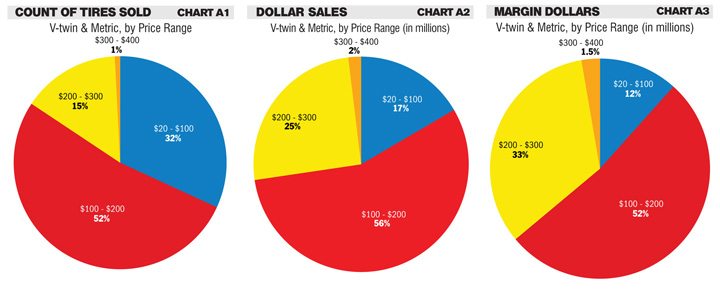

Charts A1, A2 and A3 present the importance of each tire group in unit sales, dollar sales and tire margin generated. We see that:

• The $100-$200 group dominates all three areas, with 52 percent of unit sales, 56 percent of sales dollars and 52 percent of margin generated.

• The second highest performing tire group was the $200-$300 range, with just 15 percent of unit sales but 25 percent of sales dollars and 33 percent of tire margin generated.

• The $20-$100 group holds the distinction of the most effort for the least amount of return. That group sells 32 percent of all units but yields only 17 percent of sales and just 12 percent of tire margin.

Efficient returns were produced by the $200-$300 group; a stable yield was found in the $100-$200 group; and highly inefficient returns were produced by the $20-$100 group. Sales of units exceeding $300 each were negligible, less than 2 percent in all three categories.

Efficient returns were produced by the $200-$300 group; a stable yield was found in the $100-$200 group; and highly inefficient returns were produced by the $20-$100 group. Sales of units exceeding $300 each were negligible, less than 2 percent in all three categories.

The gross margin percentage yield rises from a low of 20 percent for the $20-$100 group to a high of 72 percent margin in the $500-$600 range. However, the margin rate falls as the selling price exceeds $600, and we see a margin rate there of 42 percent.

These margin rates are surprising, and if not so uniform in their ascendency, would be suspect. It may be that with the increase in price and the corresponding decrease in the number of units sold at each level, that dealers are covering the additional risk (cost) of stocking with higher margins. More study is needed to fully understand this pricing structure.

Tires sales in parts

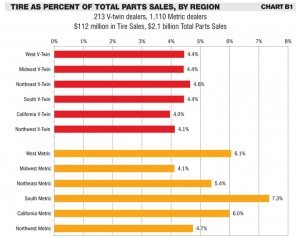

Charts B1, B2 and B3 compare tire sales to the total parts department. Chart B1 looks at six regions of the country and measures both metric and V-twin sales against total parts department sales. We see that metric dealers vary from a low in the Midwest, where tires account for 4.1 percent of all parts sales, to a 7.3 percent high in the South.

Conversely, we see that V-twin dealers are grouped tightly around the 4 percent mark. The Northeast is highest at 4.6 percent, and the California region is lowest at 4.0 percent. The average for all regions is 4.3 percent.

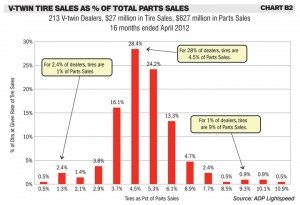

Further detail for this range of tire sales is found in charts B2 and B3. Chart B2 presents V-twin dealers’ corresponding tire sales as a percent of total parts sales. We see here that on the low end 2.4 percent of dealers run at 1 percent tire sales, and on the high end 1 percent of dealers manage tire sales at 9-11 percent of total parts sales. While these are the extremes, with some dealers ignoring tires and others focusing on not much else, the highest number of dealers — 28 percent — maintains tires at 4 percent of parts sales. It appears that most dealers run from 4-6 percent tires sales.

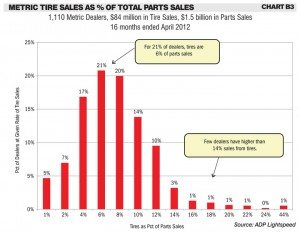

Metric is quite different. Here, we see that 5 percent of dealers sell just $1 in tires for every $100 in parts sales. Most dealers — 82 percent — sell 4-12 percent of tires out of their parts department, while the greatest concentration of them — 21 percent — are at a 6 percent level of tire sales. The high end, those dealers selling from 16-24 percent of total parts sales in tires, are very few — about 4 percent of all dealers. One dealership, obviously specializing in tire sales, derives 44 percent of parts sales from tires.

Tire inventory

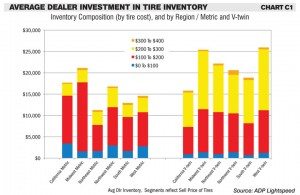

In tire inventory, again, we see great differences between metric and V-twin dealers. Chart C1 shows the composition of average dealer inventory by region, based on tire cost, for each of the six regions studied.

We find that V-twin dealers maintain a larger tire inventory than metric dealers, the high for metric being a little more than $20,000 in the Midwest, while the highest region for V-twin is slightly more than $25,000 in the Western region. A large difference in tires stocked is found in the $200-$300 range. Metric dealers stock $2,000-$4,000 in this range, while V-twin dealers stock $8,000-$14,000.

V-twin dealers in the Northwest region are much heavier in the $300-$400 range, with more than a $1,000 average per dealership. All other regions carry less than half this amount per dealership.

In a study of the average amount of tire inventory dollars in dealerships on April 18, 2012, we see that for metric, 12 percent of dealers hold $1,000-$2,000 in tires. Twenty percent are found holding $3,000-$6,000, another 20 percent at $6,000- $12,000, and yet another 20 percent holding $12,000- $25,000. In all, 60 percent of dealers stock between $3,000 and $25,000. A small 3 percent of dealers are holding more than $50,000 in tire inventory.

For V-twin dealers, we find almost half of the dealers — 48 percent — maintain $12,000-$25,000 in tire inventory. Metric dealers are most often in the $3,000-$6,000 range.

This study has shown the importance of tire sales, or the lack thereof, for dealerships across the country.

Hal Ethington has been associated with the powersports industry for more than 40 years. Ethington is a senior analyst at ADP Lightspeed. Contact him at Hal.Ethington@adp.com.