Tennessee dealers No. 1 at selling ATV accessories

ADP Lightspeed data shows Volunteer State adds lines to new units sales

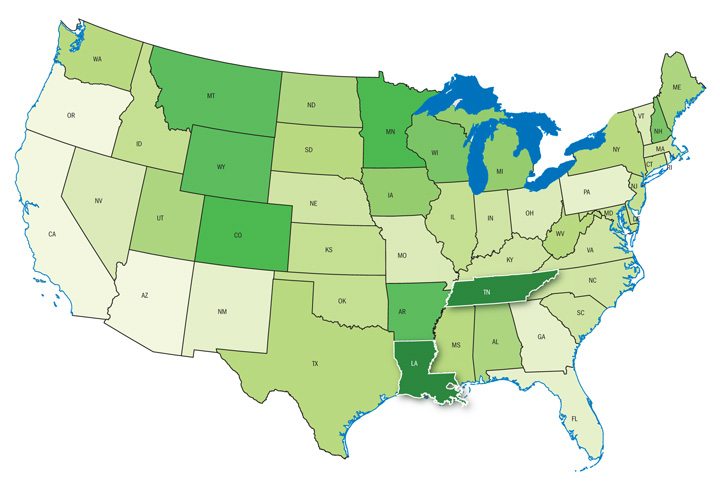

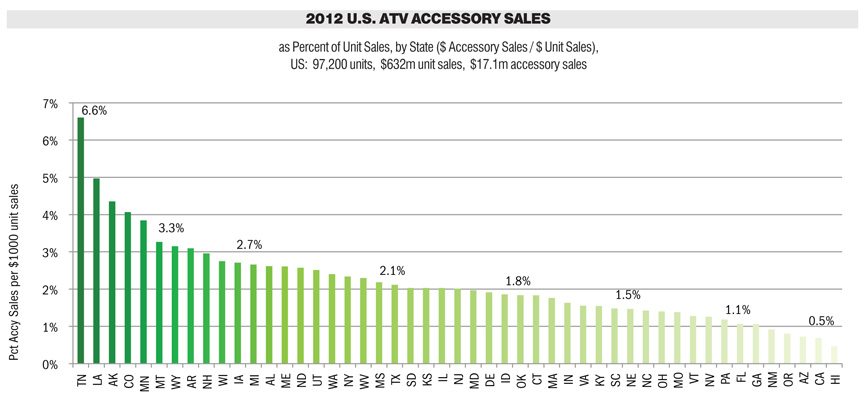

Which state has dealers who know how to add lines to new unit purchase orders? Once again, dealerships in Tennessee and Louisiana were at the top in 2012 when it comes to the amount of accessories sold with purchase of a new ATV, according to data provided exclusively to Powersports Businesss by ADP Lightspeed.

There were, however, significant changes in the performance of the top states. In addition, three new states appear in the bottom 10.

The study, compiled by ADP Lightspeed analyst Hal Ethington, compares state averages for sales of accessories with newly purchased ATVs in 2012 vs. 2011. UTVs and over-the-counter accessory sales were not included in this study.

Three states out of top 10

While Tennessee and Louisiana retain their 1-2 spots respectively for high performance, three states have fallen out of the top 10 in 2012. Maine drops from 4.78 percent down to 2.61 percent, North Dakota drops from 4.07 percent to 2.57 percent, and Iowa drops from 3.20 percent to 2.71 percent.

In addition to Tennessee and Louisiana, five others from 2011’s top 10 performers remain in the top 10 for 2012: Alaska (3), Colorado (4) Minnesota (5), Montana (6) and Arkansas (8).

The average accessory sales penetration for the top 10 states this year ran from 2.75 to 6.6 percent, with an average of 3.91 percent for the group. The average sales penetration for the bottom 10 was 0.94 percent.

“Those percentages equate to $39 in accessory sales for each $1,000 of unit sales for the top group, and just $9.40 in accessory sales per $1,000 of unit sales for the bottom 10 states,” Ethington said.

New additions to the bottom 10-ranked states during 2012 are Pennsylvania (dropping from 1.53 to 1.18 percent) and Oregon (from 1.64 to 0.81 percent). The eight states that remain in the bottom 10 for both 2011 and 2012 are: Vermont, Nevada, Florida, Georgia, New Mexico, Arizona, California and Hawaii.

In 2011, four states sold less than 1 percent of unit sales in accessories. They were California, Hawaii, New Mexico and Florida. In 2012, Arizona joined this group by falling from 1.1 percent in 2011, to just 0.72 percent in 2012.

“The changes in two particular states are difficult to understand,” Ethington said. “Maine drops from $47.80 per thousand in 2011 to just $26.10 per thousand in 2012, or about half. That state remains strong in ATV usage, but it is possible that the movement from ATVs to highly accessorized UTVs has happened there at a more accelerated pace than in other states, eroding the ATV market. Again, this study is confined to ATV vehicles, and does not include UTV sales.

“North Dakota may be a similar case. The economy in that state is robust and growing due to the expansion of oil production there, but we see a drop from $40.70 per thousand to just $25.70 per thousand. Again, about half. Further study is needed to understand this phenomena, but dealers in both of these states would be advised to review their ATV accessory sales and see if there has been a diminished focus on that market segment in their stores.”

A look northward

Canada was included in the study this year, and the results show a strong accessory market in that country. Ten of the 13 provinces and territories are represented in the study. Ethington reports that Nunavut, Quebec and the Yukon are excluded, either for lack of data or lack of Lightspeed dealers who sell ATVs in that market.

Canada was included in the study this year, and the results show a strong accessory market in that country. Ten of the 13 provinces and territories are represented in the study. Ethington reports that Nunavut, Quebec and the Yukon are excluded, either for lack of data or lack of Lightspeed dealers who sell ATVs in that market.

For the Canadian reporting provinces and territories, interestingly, eight of the 10 show an accessory sales rate that would put them among the top 10 U.S. states. They range from 2.75 percent in Newfoundland and Labrador to more than 6 percent in the Northwest Territories — all of them at, or well above, the U.S. minimum top 10 rate of 2.75 percent. For the other two provinces, Saskatchewan pulls a 0.29 percent ($2.90/$1,000), and Prince Edward Island has the lowest rate recorded for all of North America at 0.03 percent ($0.30 per $1,000).

“This study has shown the wide variance between the states, provinces and territories in their success at selling ATV accessories with new units. Even among the top 10 performers, the top state is double the rate of the lowest state,” Ethington said. “Dealers in low performing states may benefit by investigating sales in high performing states, and identifying unmet customer needs in their own stores.”