Mystery shopper title goes to Ducati dealers

Industry average increases in Prospect Satisfaction Index

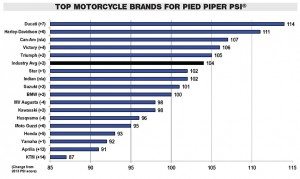

Ducati dealers took a big jump in the 2014 Pied Piper Prospect Satisfaction Index, up 7 points from 2013. The 114 score helped them surpass Harley-Davidson dealerships’ score (111) and lead the industry for the first time since 2009.

The change, Pied Piper president Fran O’Hagan said, was due to a shift in how Ducati uses mystery shopping as a training tool. Ducati in 2013 chose a mystery shopping method similar to what Mercedes, the top PSI-scorer on the auto side, implemented with its dealers about five years ago.

“Mercedes said ‘We’re going to put money on the line to make mystery shopping worth your while. But we’re not putting money on the line tied to scores; we’re putting money on the line tied to you using this as a tool, that’s all. But you have to use it, and we’re going to make you sit down with your Mercedes reps once a quarter and review your mystery shop results with them and talk to them about how you’re using the results to improve the way you sell,’” O’Hagan explained.

“That is exactly what Ducati did. Ducati copied that approach and started at the tail end of 2013, and it’s running today, so Ducati incentivizes the dealers to use mystery shopping. Ducati doesn’t particularly pay attention to the scores; what they’re paying attention to is that the dealers are actually using the results to improve the way they sell, and the Ducati reps are doing the same thing. The Ducati reps are talking to the dealers about what are you doing, and what can you do to improve. There has been huge improvement,” he added.

Because of that change, Ducati led the charge and improved its own score in a number of PSI categories. Ducati dealers, for example, encouraged customers to sit on a bike 84 percent of the time, topping its score of 68 percent of the time in 2013.

“We call it — with a smile on our face — the poor man’s test ride, and we know that if you encourage the shoppers to sit on a bike, you sell more motorcycles. That math is very clear,” O’Hagan said.

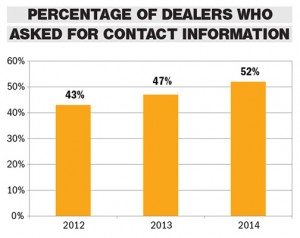

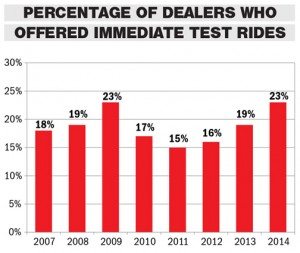

But Ducati dealers also got riders out on demos more than their counterparts, offering immediate test rides 26 percent of the time, an improvement from 14 percent last year. When it came down to encouraging prospects to sit down at a desk, Ducati dealers offered that 45 percent of the time, compared to 30 percent in ’13. As for asking for contact information, Ducati dealers did that 60 percent of the time, a 20-percentage-point improvement over a year ago.

“To put it in perspective, a change from like 30 percent to 33 percent is noteworthy, so these big jumps that we see across the whole network of over hundreds of shops, that’s huge, huge shift in behavior,” O’Hagan said.

Harley dealers also succeed

Though Harley dealerships had to settle for second place this year, the brand still sits 7 points ahead of the industry average, and its dealers led in a number of categories.

“They do very well with giving compelling reasons to buy from this dealership, as opposed to just selling the product,” O’Hagan reported. “You know, I’m not just selling a Fat Boy; I’m selling you should buy from ‘O’Hagan Motors’ because of this, this, this, this and this. And every dealership can come up with good reasons why somebody should buy from them. The blessing with that approach is it makes it less about the deal, and gross profit improves.”

Harley-Davidson salespeople sell the dealership in that manner 57 percent of the time. The industry overall does the same 47 percent of the time, and Honda dealers focus on that only 32 percent of the time.

Harley dealers also focus on the completion of a sale by encouraging going through the numbers or writing up a deal 41 percent of the time, compared to Honda dealers, who do the same 33 percent of the time.

“It’s interesting, the stereotype of a vehicle salesperson, let’s say a car salesperson, is that they sell too hard, you know they’re too overbearing, where the facts are just the opposite. The facts say that it’s four times more likely that a salesperson will not sell hard enough, and I’m talking about the car business. Motorcycle business, it’s even worse,” O’Hagan said. “Motorcycle business has much more of a problem with museum curator mode, where I’m smiling, and I’m happy, and I’m friendly, and I’ll answer any questions you have about this bike, but I stop short from actually selling it to you.”

Harley also leads the pack when it comes to suggesting sitting down at a desk and mentioning the availability of financing options.

Harley and Ducati dealers combined to lead half of all the study’s questions. Ten other brands also took top spots in at least one category each.

Industry improvement

Though Ducati dealers topped the charts this year, the industry overall experienced a 2-point improvement to a score of 104. That, and the results from a number of important categories, shows O’Hagan that the industry is paying attention to its sales skills.

“It’s fascinating, to me anyway, to look and see how the whole industry has changed for specific questions because there’s been some huge improvement,” he said. “If I boiled it all down to a headline, I would tell you that the typical motorcycle salesperson is much more professional today. They know how to sell; they’re much more likely to know how to sell — the very basics.”

Though Ducati led the asking for contact information category, the industry’s dealer body as a whole also improved in that category, asking for contact details 52 percent of the time, compared to 47 percent last year and 38 percent in 2007. Along with Ducati, Harley-Davidson (67 percent of the time), Can-Am, Victory and Triumph also scored well with that question.

As for suggesting writing up a deal, the industry’s score improved from 30 percent three years ago to 39 percent in 2014, with Can-Am, Harley-Davidson, Suzuki, Ducati and Triumph leading the charge.

In the “attempted to forward the sale,” category, which includes any action that moves the customer from talking about the product to talking about the sale, such as suggesting writing up a transaction or sitting down at a desk or asking a customer to buy today, dealers have seen marked improvement. When the PSI motorcycle study started in 2007, only 45 percent of salespeople attempted to forward the sale. Last year that number was 53 percent, and this year it reached 63 percent.

Can-Am Spyder and Indian dealers were both added to the list for the first time this year, though Pied Piper has been monitoring Indian for several years. Can-Am’s first time on the chart earned the brand an above-indsutry-average score of 107, and Indian wasn’t far behind with a 102.

Though the top OEMs were the biggest contributors to the industry’s increase in 2014, KTM (measured by on-road bikes only) and Aprilia, which had the worst scores overall, both saw double-digit increases.

Can I help you?

While dealers have come a long way in many categories and some individual stores have achieved 100-percent scores on some questions, the industry overall still has a few hurdles to overcome.

One that O’Hagan noted this year was the likelihood of salespeople to ask, “Can I help you?” In 84 percent of the mystery shopping trips conducted, salespeople asked that question.

“That’s a pretty striking statistic because if you talk to any sales trainer — and this isn’t unique to motorcycles — anyone being taught to sell is taught to ask open-ended questions, and you’re also taught to make a positive first impression. And the best you can do for your positive first impression is ‘Can I help you?’” O’Hagan said. “And the craziest part of that is half the time the response is, ‘No thanks, I’m just looking.’ Now what the customer really is saying is, ‘I don’t know you.’ What they’re really saying, I mean if you gave them truth serum, what they’d say is, ‘I’m so psyched I’m in a motorcycle dealership! I mean this is wonderful! I have all kinds of things to say!’ But what they’re really saying is, ‘I don’t know you. You’re a salesperson. I’ve been conditioned to send you off because you’re going to bother me.’”

Test rides

When it came to the all-important test ride category, dealers again improved.

As far as offering an immediate demo, dealers made the suggestion 23 percent of the time, returning to a level not seen since 2009. It’s a number O’Hagan is happy to see improve because of sales implications.

“Salespeople who offer immediate test rides half the time — not even 100 percent of the time — sell 44 percent more motorcycles on average, than the group of dealers who do not offer immediate test rides. I mean, it’s not subtle, so it’s been interesting to watch it change,” he said.

Future test rides have also seen improvement. Pied Piper began measuring salespeople offering a future demo in 2010. Since then, the industry average has hovered around 20 percent, but this year it increased to 29 percent, which O’Hagan says is promising.

“We’ve found that there’s about an 80 percent close rate on those come-back test rides, so even if I have a bike on the showroom floor, and I have to take it off and prep it and run the risk that I’m turning it into a slightly used bike, I need to do that,” O’Hagan said.

When immediate test ride offers are added with suggestions of future demos, the numbers look even brighter, with 52 percent of dealers offering one or the other, compared to 39 percent in 2013.

“Pretty much everybody agrees that test rides sell motorcycles. The only bone of contention is well, it’s kind of difficult to provide test rides, and we could list a dozen reasons why test rides for motorcycle dealers are complicated. Logistically, they’re difficult,” O’Hagan said. “On the other hand, we see this math that says some dealers who have figured it out. They figure out a way to make it happen, and let’s look at how many bikes they sell — well, lo and behold, they sell a whole lot more bikes than the dealers that don’t.”

The improvement in test rides, mixed with increases in other categories, shows that the industry is on an upswing in terms of prospect satisfaction.

“The math is just so clear that dealers who follow these very simple behaviors religiously end up selling a whole lot more motorcycles,” O’Hagan said. “So when the PSI scores go up, that’s telling you that the dealer networks are selling more effectively, and selling more effectively means higher sales, so it’s great for the industry when the PSI index goes up.”