Improved new sales conditions reported

Strong side-by-side sales expected to continue

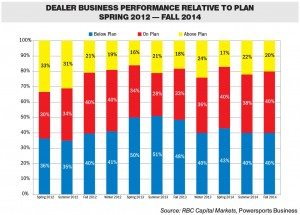

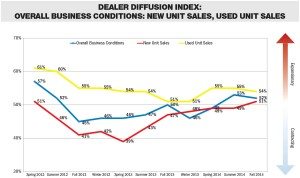

Powersports Business recently conducted a quarterly joint dealer survey (114 dealer participants from 39 states and Canada) with RBC Capital Markets. RBC analyst Joe Spak reports that the “dealer business conditions index suggests an overall sequential decline from last quarter, but the new sales condition, which is most relevant for our powersports coverage, improved sequentially. We believe industry side-by-side retail sales growth in 3Q14 was modestly slower than 2Q14. Meanwhile, ATV, motorcycle and PWC retail sales appear to have grown at a similar pace to 2Q14. Looking ahead, we didn’t see much of a change in dealer expectations for NTM (next 12 months) sales from last quarter in the key categories (side-by-sides, ATVs, motorcycles). The economy and consumer may need to strengthen to see much stronger category demand. Amid flattish growth, innovation becomes even more crucial.”

Below, Spak looks at retail performance by segment in Q3, according to the dealer survey:

SIDE-BY-SIDE

“We believe SxS industry retail sales grew high-single digits this quarter, below the low teens in 2Q14 but still a strong level. Dealers still expect NTM sales to be relatively strong; those expectations haven’t changed since last quarter. Inventory concerns have eased since 2Q14 while promotional activity appears to have subsided since our 2Q14 reading.”

MOTORCYCLE

“Overall, motorcycle industry sales growth seems similar to last quarter — up 1-3 percent. Survey respondents indicate that the metric brands have been disappointing especially as it comes to new product, so further share loses are likely (potential positive for HOG, PII). There is still some concern over the future of motorcycle industry growth, but our research shows this could cycle higher with construction. Inventory concerns stepped up again this quarter, though it seems mostly centered around some of the metric brands — Ducati, Triumph and Victory while Harley and Indian inventories are better. Despite the inventory issues, promotional activity still mostly in check. We are keeping a watchful eye.”

ATV

“Industry ATV 3Q14 sales growth and NTM expectations both look modestly better than 2Q14 but still fairly low levels.”

SNOWMOBILE

“NTM expectations appear pretty upbeat with inventories as lean as they have been in over a decade.”

POLARIS TAKE

“Dealer feedback on new ORV product lineup is very solid. New Ranger products very well received and excitement is high for Slingshot. Expectations for Indian retail sales over the next 12 months increased, likely as a result of the expanded product lineup.”

HARLEY-DAVIDSON TAKE

“Destocking occurred with the announced shipment reduction and some attractive financing programs. Dealers seem excited about the MY15 lineup (return of Road Glide, Street).”

BRP TAKE

“Dealer responses support our expectation for a stronger second half, with a solid NTM outlook for Spyder, SxS (SSV), ATV and especially snowmobiles. New models are driving the positive outlook — the new Spyder F3 (shipping FQ4), the 121-hp Maverick SSV, and the Outlander L ATV (a new entry in the midrange segment).”

Here’s how select dealers answered our question: Please tell us anything you wish to add about the current powersports business environment and your outlook. Responses are and always will be anonymous.

Our major concern is land closures, finding and retaining quality long-term employees in our market.

OEMs still trying to have dealers take unneeded inventory.

The major difference in the powersports business now and 2007 is the present lack of retail financing.

BRP Certification program is hard on dealers. Have to order PAC that does not sell for us.

With credit being so tight, it’s hard as a dealer to sell to people who do not qualify for a loan.

Think it will keep at the level it is but concerned on side-by-side and the current land issues.

If people mind their business and focus on the customers, they will be fine.

Hope 2015 more people walk in the door. Triumph needs to help dealers, or they will loose a lot of them.

Still too much pressure from OEMs to buy and stock, especially on bikes.

Yamaha street bike sales don’t look positive.

Hoping that Triumph finally gets back on track now that they fired that CEO and does something to help their dealers out.

WINNING DEALERS

The following dealers who completed the Powersports Business/RBC Capital Markets Q3 2014 Dealer Survey were randomly selected to win a $100 Best Buy gift card, courtesy of RBC Capital Markets.

Butch Miller, Honda Polaris of North Texas,

Sherman, TX

Pete Daniel, Ultimate Cycle, Pohatan, VA

Mick Cawthorn, Kane’s Harley-Davidson,

Calgary, Alb.

Dennis Revell, Honda of the Ozarks, S

pringfield, MO

Roger O’Hotto, Boomerang Sports, Melrose, MN

All dealers who complete the survey receive a PDF analysis of the results from RBC Capital Markets and are eligible for the $100 Best Buy gift card.